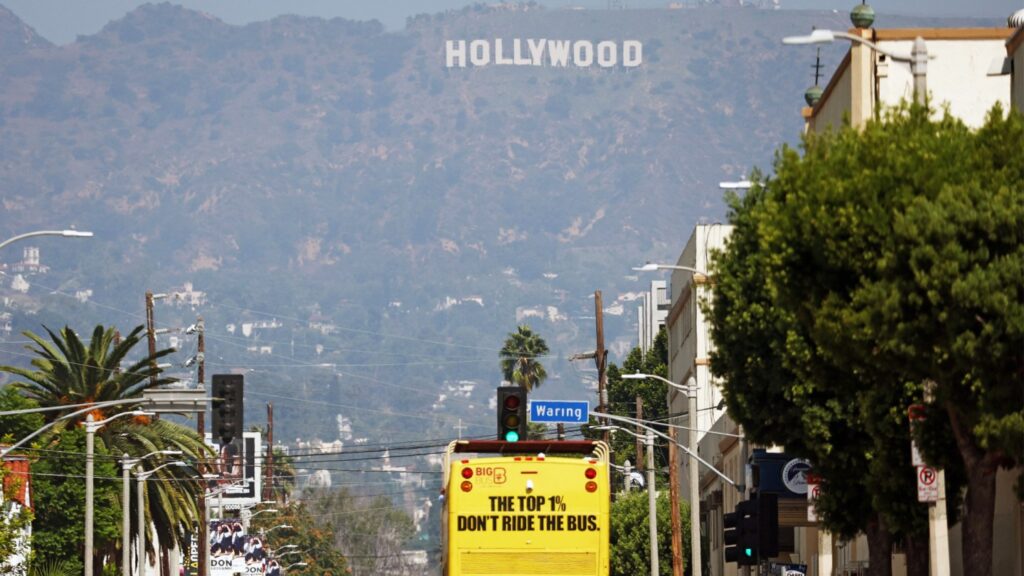

Master chef. Supergirl. The Kelly Clarkson Show. All of these productions were originally shot in California, but they were convinced to leave California, at least in part because of more favorable tax credits in other regions. Now, Gov. Gavin Newsom is stepping in as runaway productions and Hollywood cost-cutting threaten the state’s control over the film and television business.

Newsom is expected to reveal on Sunday that his initial budget proposal will significantly increase the current cap on California’s tax relief program for all producers from $330 million to $750 million a year. Become. The expansion would provide up to $3.75 billion in tax credits to the industry over five years starting in 2025.

If passed, the grant would be the most generous of any state other than Georgia, which has no cap on annual production costs. That includes New York, Hollywood’s No. 2 favorite, and California is increasingly fighting over production amid a competitive incentive race to attract Hollywood money. .

“This means film production can survive,” says Los Angeles Mayor Karen Bass. “This means all the jobs that would be lost to go to other states or overseas will stay here.”

Further changes to the program have not yet been finalized. Possible amendments could affect the maximum amount that a single product can receive in tax relief and what types of expenditures are eligible for incentives.

“We will be looking at various potential additions and modifications to existing programs,” said Colleen Bell, director of the California Film Commission, which oversees film and television production across the state. “Everyone is committed to attracting production from California. We are investing in our leaders and hiring them so Californians can do the jobs they want to do and keep the paychecks in their pockets.” must be maintained.”

The move comes after Los Angeles-area entertainment industry workers have been vocal for months about the lack of job opportunities at the iconic production hub. Local staff and creators describe a return to anemic production as major companies seek to cut costs and the era of peak TV comes to a screeching halt in the wake of the 2023 writers’ and actors’ strike did.

Some of these workers experienced severe economic hardship due to the strike and its aftermath. People are selling their homes, living in cars or RVs, making frequent trips to food banks, and some are quitting their jobs entirely to take on other fields. Increased tax incentives for productions across the state were proposed as a remedy for the situation in June during labor negotiations for crew members affiliated with the Los Angeles-area Hollywood Basic Crafts Union.

A month later, Bass formed a task force in Los Angeles to accelerate the industry’s recovery after the pandemic, strikes and industry cutbacks disrupted production. One of the top priorities is expanding the state’s tax film and television tax credit program.

“This was at the top of their agenda,” Bass said.

Filming in Los Angeles is nearing historic lows, with the three months from July to September having the fewest shooting days this year, according to new data released on October 16th. This number is also lower than the number of shoots in the region during the same period last year, when work stoppages brought the industry to a halt. One of the biggest concerns is the sharp decline in unscripted television production. Last quarter, the number of shoots in this category was down approximately 56% compared to the same period last year. Television filming, long the region’s main filming hub, continues to decline as all categories of scripted production are below historical standards.

Rebecca Lyne, associate national executive director and western executive director of the Directors Guild of America, said production in the state is currently in a “real crisis.” She added that the governor’s proposal “provides important recognition that this is an industry we want to keep in California.”

Rein said the DGA and other industry unions are working with the Newsom administration on production concerns, including “high unemployment, the out-migration of labor, and the inability to compete effectively with incentives from other countries.” “We’ve spent a lot of time” talking, he said. ” she says. “I think the governor was listening, too.” Rein said the film industry provides lucrative, middle-class employment for industry workers, and that the film industry provides lucrative, middle-class employment for industry workers, and that the film industry provides a variety of local and indirect businesses across the state, from dry cleaning services to florists. The government emphasizes that it is creating jobs for many beneficiaries.

Newsom’s proposal is aimed at alleviating one of the major problems with California’s film and television tax incentive program: too many production companies applying for subsidies. If these projects are rejected, they leave for other states or countries. Since 2020, the state has lost $1.6 billion in production costs that applied for tax credits but were not received, according to the California Film Commission.

“There’s no denying that one of the main considerations for where a project will be filmed is the availability of tax credits,” Bell says. “Our program has been oversubscribed for a long time. Because we have this cap, we have no choice but to reject eligible work, move that project elsewhere, and move work for Californians.” There wasn’t.”

Tax credits may make it easier for production companies to withstand higher costs such as labor and filming permits in California than in other regions.

Still, the state will continue to face stiff competition. The 20% base credit offered by California is lower than most competitive film hubs, including New York, New Mexico, and the United Kingdom. Producers who are also the only major production hubs that have a ban are excluded from the incentives. This is a peculiarity that the UK and Canada, another filming hotspot with the added advantage of favorable exchange rates and low labor costs, have leveraged to become major production destinations.

California also does not offer a standalone tax credit for visual effects. Some productions have outsourced their post-production work to countries that offer generous subsidies on this front, resulting in many state-based VFX companies setting up overseas branches. .

Canada and Australia offer the most favorable tax breaks in this regard. Productions can recoup at least 30 percent of their post, digital, and VFX spend in these regions. In March, the UK announced a 5% increase in domestic VFX costs and the removal of an 80% cap to maintain competitiveness.

In addition to the cap increase, the California Film Commission cited the lack of tax credits for VFX work alone for the governor’s office. “We’re doing everything we can to win,” Bell said.

Compared to California, other regions have weathered industry declines better. Some data shows that filming levels in competing international film hubs are flat or, in some cases, slightly rising. Data from industry intelligence platform ProdPro shows that in the last quarter, the UK and Canada each saw live-action scripted titles with budgets of $10 million or more actively filming within their borders.

It’s not just outside the US. New York has proven more resilient than California, with about 75 percent of its 2022 mass shooting levels.